Archive

On Stock Market Valuations, some light to the recurring scandals

“There must certainly be a vast Fund of Stupidity in Human Nature, else men would not be caught as they are, a thousand times over, by the same Snare, and while they yet remember their past Misfortunes, go on to court and encourage the Causes to which they were owing, and which will again produce them.” – said Cato several thousand years ago (from The Battle for the Soul of Capitalism)

Here’s an interesting analysis from John C. Bogle‘s book “The Battle for the Soul of Capitalism”

“When the S&P Index rose from 130 in March 1981 to 1,527 in March 2000, the return on investor capital, excluding dividends, was 13.8 percent per year. Earnings growth amounted to 6.2 percent annually, less than half of the return, with the remainder the result of a rise in the price-earnings ratio from eight times to thirty-two times. That increase alone accounted for 1,100 points of the 1,400-point gain, or 7.6 percent per year. If one were to attribute even a 5 percent corporate cost of capital as a threshold for stock option grant- a return a company might have earned merely by placing all of its assets in a bank certificate of deposit- corporate management could claim responsibility for an extra 1.2 percent per year.” (emphasis added)

So how does Wall Street manage to “meet” or “exceed” their generous quarterly guidance with such a high success rate? Here’s an example:

“In 2001, Verizon Communications reported a net income of $389 million and awarded its executives bonuses based on that amount. Net income would have been negative, however, had the company not included $1.8 billion of pension income. Thus, Verizon was able to use pension earnings to convert net income to profits, giving the firm cover to provide managers with higher bonuses [and meeting expectations, and keeping their stock options way high in the black]. It gets worse. It turns out that Verizon’s pension funds did not generate any real income in 2001; they had negative investment returns, losing $3.8 billion in value [What?!]. How then, could Verizon report income of $1.8 billion from its pension assets? The company merely increased its projection of future returns on pension assets to 9.25 percent, a move allowed under the accounting rules then in effect. Thus, the $1.8 billion in pension income used to move Verizon into the black did not even reflect actual returns generated by the pension funds. The pension income was simply the result of a change in the accounting assumptions. This certainly did not create any value for the firm or its shareholders.” (emphasis added)

OK, so lets do this simple math. They claim they made $389 million in net income, because of the $1.8 billion of magic pension fund money that doesn’t exist. This means they actually lost $1.4 billion, but that’s not it. They didn’t make $1.8 from pension, rather lost $3.1 billion in value for that fund.

Who ends up carrying those losses? The individual investors, fooled to believe a company is stable, holds the stock and takes the heavy losses when all the cards in the table are finally shown at once.

Acquisition Opportunity for Yahoo or Google- Marchex

Last time I analyzed CNET’s individual assets, the company was acquired 4 months later. Now, amidst the current economic nightmare, there is a fresh new opportunity to grab a gift – Marchex (MCHX). Yahoo, who’s recent conflicts have left many asking for Yang’s head and who’s stock has lost almost 50% since failed negotiations with Ballmer, has a small opportunity to vindicate themselves.

Of course, there’s also Google who needs to continue increasing their revenues in order to support their generous stock PE. Although I would insist that this is a more logical acquisition for Yahoo! to build themselves into a more attractive position for Yahoo! to be acquired, possibly still by Microsoft.

So, what does Marchex bring to the table?

High quality traffic and prime Internet Real Estate.

By its own, Marchex is priced slightly below their current value. However, when you take Google or Yahoo’s advertiser base and traffic sources and fuse it with Marchex’s high quality domain portfolio you get a multiplier effect.

Marchex has made two brilliant moves:

1. Spanish domain portfolio acquisition

This portfolio contains over 100 of the most attractive Spanish domain names and was calculated to generate more than one million unique visitors per month. Of course, these are mostly visitors coming straight to the sites, because of type-in traffic. Take a look at the jewels:

mujer.com (women.com)

fotos.com (photos.com)

deportes.com (sports.com)

salud.com (health.com)

peliculas.com (movies.com)

mascotas.com (pets.com)

futbol.com (soccer.com)

cocina.com (kitchen or cook.com)

tarjetas.com (cards.com)

dietas.com (diets.com)

computadoras.com (computers.com)

The whole list is found here http://www.emediawire.com/releases/2007/5/emw527846.htm

The value of these domain names are like a slow curve that quickly accelerates exponentially as the Spanish market (Spain, Mexico, Caribbean and South America) online advertising solidifies. One must understand that this market has been extremely slow to develop, mostly because of the number of computers available in each household and lack of understanding from old school marketing executives. However, the panorama is changing quickly and will fuel advertiser dollars to the ‘net.

The Spanish domain portfolio could be easily worth $500 million to $2 billion in a 5 year window, depending on the development of all these domain names into fully usable content and social portals.

The second source of value in Marchex is their 2004 acquisition of UltSearch’s domain portfolio.

In this portfolio, there are over 100,000 domain names of high search traffic value. There are also a few generic jewels in the mix like beijing.com, debts.com, and remodeling.com.

It’s hard to value the whole portfolio and I suspect that most of the names would probably not be of any significant worth. However, assuming even 1% of the names are of the quality of debts.com and beijing.com would make the portfolio highly attractive.

I wouldn’t doubt that this portfolio had at least $100 million in value (Marchex paid over $150 million a few years ago for the portfolio).

Finally, someone over at Marchex decided to accumulate zip code domain name. Wrap them up, put a bow on top of them and sell it for a few million to some telephone company still figuring out their online strategy. I’d also garage sale the auto content generation technology.

Marchex is currently priced at $300 million. Year-to-date they are down almost 30%. This is exactly how much it is worth.. a 30 to 50% premium on its current price.

Alibaba IPO and Yahoo Valuation

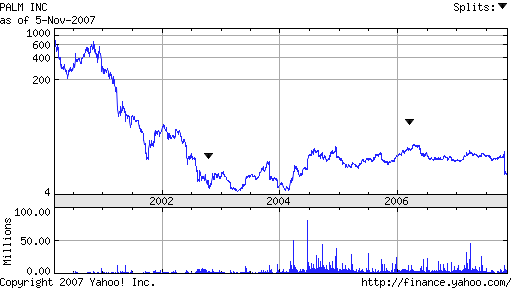

Call me old, but am I the only one that remembers the Palm IPO? OK, so I was among the cattle desperately trying to get shares of Palm, back in the day – March 2000. Now, something with Alibaba smelled very similar to that Palm IPO…

March 2000:

- Palm IPO rises 150% by closing bell

- Palm closes opening day with a $53 billion market cap

- Main Palm shareholder 3com rises drastically as a result of Palm’s market cap

November 2007:

- Alibaba IPO rises 193% by closing bell

- Alibaba closes first day of trading with a $25.7 billion market cap

- Main Alibaba shareholder Yahoo! drops 4.6%???

OK, so Mr. Yang is in the hot seat, but is it so serious as to discount the more than $6 billion they just made off of the Alibaba IPO, plus a nearly $2 billion more in the drop of today?

Then again, investors could be discounting the huge dot-comish PE that Alibaba carries.

Oh, and for those of you wondering how Palm did ever since that monumental IPO… PALM Market Cap: $0.9 billion